Key figures, Cashflow, P&L and balance sheet

Key figures

| FY 2023 | FY 2022 | FY 2021 | FY 2020 | FY 2019 | FY 2018 | FY 2017 | FY 2016 | FY 2015 | |||

| Incoming orders | € m | 4,615.5 | 5,008.4 | 4,291.0 | 3,283.2 | 4,076.5 | 3,930.9 | 3,803.0 | 3,701.7 | 3,467.5 | |

|

Orders on hand (December 31) | € m | 4,201.2 | 4,014.0 | 3,361.0 | 2,556.7 | 2,742.8 | 2,577.2 | 2,449.4 | 2,568.4 | 2,465.7 | |

| Sales | € m | 4,627.3 | 4,314.1 | 3,536.7 | 3,324.8 | 3,921.5 | 3,869.8 | 3,713.2 | 3,573.5 | 3,767.1 | |

| EBITDA | € m | 322.2 | 337.5 | 299.4 | 125.3 | 308.5 | 326.9 | 367.7 | 360.3 | 348.2 | |

| EBIT before extraordinary effects | € m | 280.4 | 232.2 | 199.1 | 99.5 | 263.1 | 274.9 | 283.7 | 286.4 | 294.3 | |

| EBIT | € m | 191.4 | 205.9 | 175.7 | 11.1 | 195.9 | 233.5 | 287.0 | 271.4 | 267.8 | |

| Financial result | € m | -20.2 | -17.8 | -43.1 | -29.7 | -21.2 | -13.8 | -19.8 | -13.3 | -23.3 | |

| Interest cost | € m | 57.9 | 30.6 | 51.0 | 39.7 | 33.4 | 27.5 | 27.7 | 26.5 | 33.5 | |

| Net income / loss of the Dürr Group | € m | 110.2 | 134.3 | 84.9 | -13.9 | 129.8 | 163.5 | 199.6 | 187.8 | 166.6 | |

|

Total asset (December 31) | € m | 5,156.0 | 4,530.9 | 4,153.6 | 3,878.8 | 3,882.3 | 3,614.4 | 3,511.6 | 3,348.5 | 2,986.7 | |

|

Equity (incl. minority interests) (December 31) | € m | 1,177.0 | 1,124.2 | 1,005.6 | 908.1 | 1,043.4 | 992.2 | 900.5 | 831.0 | 714.4 | |

|

Equity ratio (December 31) | % | 22.8 | 24.8 | 24.2 | 23.4 | 26.9 | 27.4 | 25.6 | 24.8 | 23.9 | |

| FY 2023 | FY 2022 | FY 2021 | FY 2020 | FY 2019 | FY 2018 | FY 2017 | FY 2016 | FY 2015 | |||

|

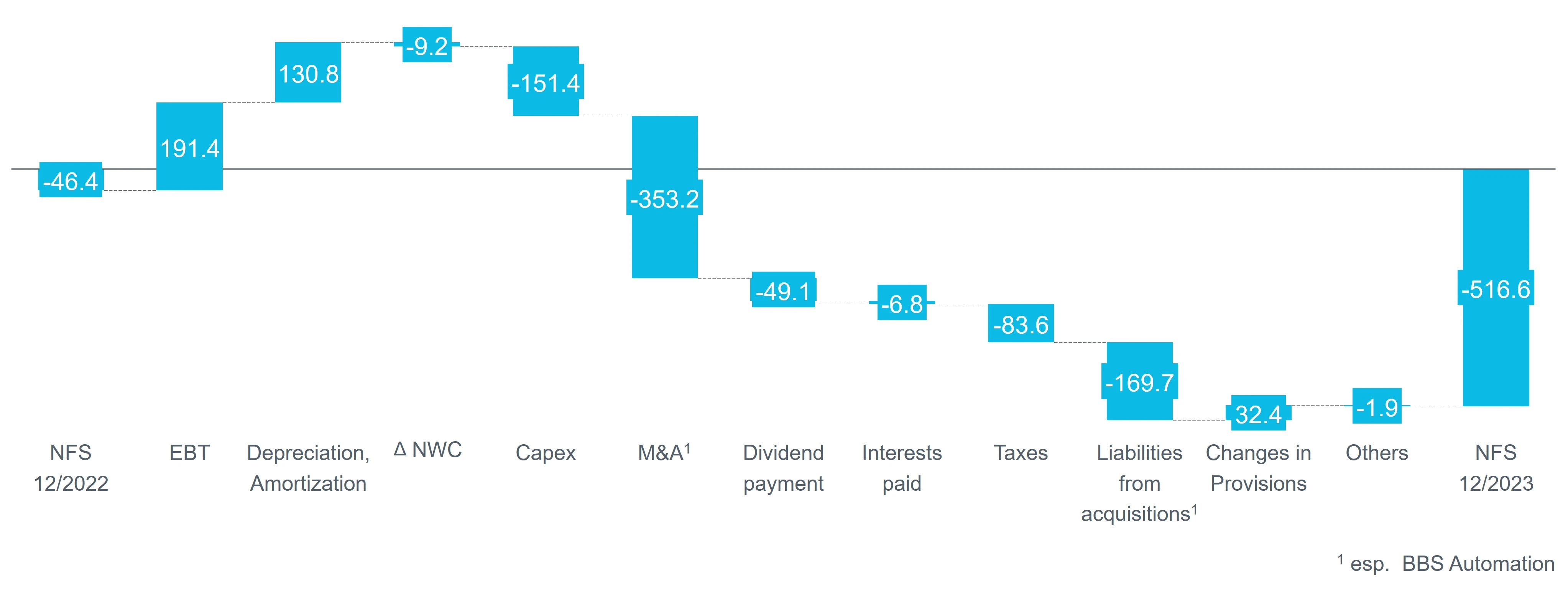

Net financial position (December 31) | € m | -516.6 | -46.4 | -99.5 | -49.0 | -99.3 | 32.3 | 176.3 | 176.5 | 129.4 | |

|

Net working capital (December 31) | € m | 545.3 | 415.9 | 427.9 | 382.6 | 502.7 | 441.4 | 373.7 | 194.4 | 236.8 | |

| Gearing (Net financial debt/Net financial debt + Equity) (December 31) | % | 30.5 | 4.0 | 9.0 | 5.1 | 8.7 | -3.4 | -24.3 | -27.0 | -22.1 | |

| Net financial debt/EBITDA | 1.6 | 0.1 | 0.3 | 0.4 | 0.3 | - | - | - | - | ||

|

EBT/Interest expense (interest coverage ratio) | 7.9 | 10.8 | 4.1 | 0.5 | 7.3 | 11.5 | 13.4 | 13.7 | 10.7 | ||

|

Cash ratio (December 31) | % | 37.7 | 29.2 | 27.9 | 35.7 | 37.1 | 35.7 | 36.2 | 50.0 | 26.4 | |

| ROCE (EBIT/Capital employed) | % | 11.2 | 17.3 | 15.5 | 1.1 | 16.9 | 24.0 | 38.6 | 41.1 | 45.3 | |

| Dürr Group Value Added (DGVA) | € m | -35.3 | 18.3 | 38.8 | -66.0 | 39.4 | 76.0 | 142.7 | 142.5 | 146.2 | |

|

Employees (December 31) | 20,597 | 18,514 | 17,802 | 16,525 | 16,493 | 16,312 | 14,974 | 15,235 | 14,850 | ||

| Excerpt of non-financial key figures | FY 2023 | FY 2022 | FY 2021 | FY 2020 | FY 2019 | FY 2018 | FY 2017 | FY 2016 | FY 2015 | ||

| Energy consumption1 | MWh per € m sales revenues | 29.1 | 31.7 | 36.1 | 37.4 | 33.6 | 30.7 | 33.6 | 36.7 | 34.1 | |

| Greenhouse gas emissions (Scope 1+2)1,2 | t CO2 equivalent per € m sales revenues | 5.5 | 8.1 | 13.7 | 14.8 | 14.5 | 15.8 | 16.9 | 17.6 | 16.5 | |

| Water consumption3 | m3 per € m sales revenues | 39.2 | 44.5 | 49.6 | 50.2 | 51.5 | 52.0 | 56.1 | 51.4 | 50.9 | |

| 1 2020 und 2019 figures adjusted due to recalculation based on Greenhouse Gas Protocol in 2021 | |||||||||||

| 2 2022 figure was adjusted retrospectively | |||||||||||

| 3 Water consumption for BBS Automation was not recorded for 2023 | |||||||||||