Good reasons to be invested in Dürr

World market leader:

The Dürr Group is one of the world’s leading mechanical and plant engineering firms with a diversified product portfolio. Market entry barriers are high. We operate in niche markets, where we are either the market leader or among the largest suppliers, with market shares ranging from 15% to 55%.

Service potential:

The service business has above-average margins and makes a particularly significant contribution to customer loyalty. We are aiming to achieve a service share in Group sales of consistently at least 30%. To that end, we align our → service activities with the entire lifecycle of our machines and systems, benefitting from an increasing number of installed machines and systems.

Market positioning:

Very good geographic positioning: Thanks to our international presence, we are represented in all of the world’s key market regions. About 40% of the business volume comes from emerging markets. Around 36% of the employees operate in these markets.

Growth:

We have set ourselves the goal of increasing sales by 5% to 6% annually to over €6 billion in 2030. The → established business is expected to contribute to this with growth rates of 0% to 2% or 3% to 9%, depending on the activity. In the → growth business, we expect average growth rates of more than 10% p.a.

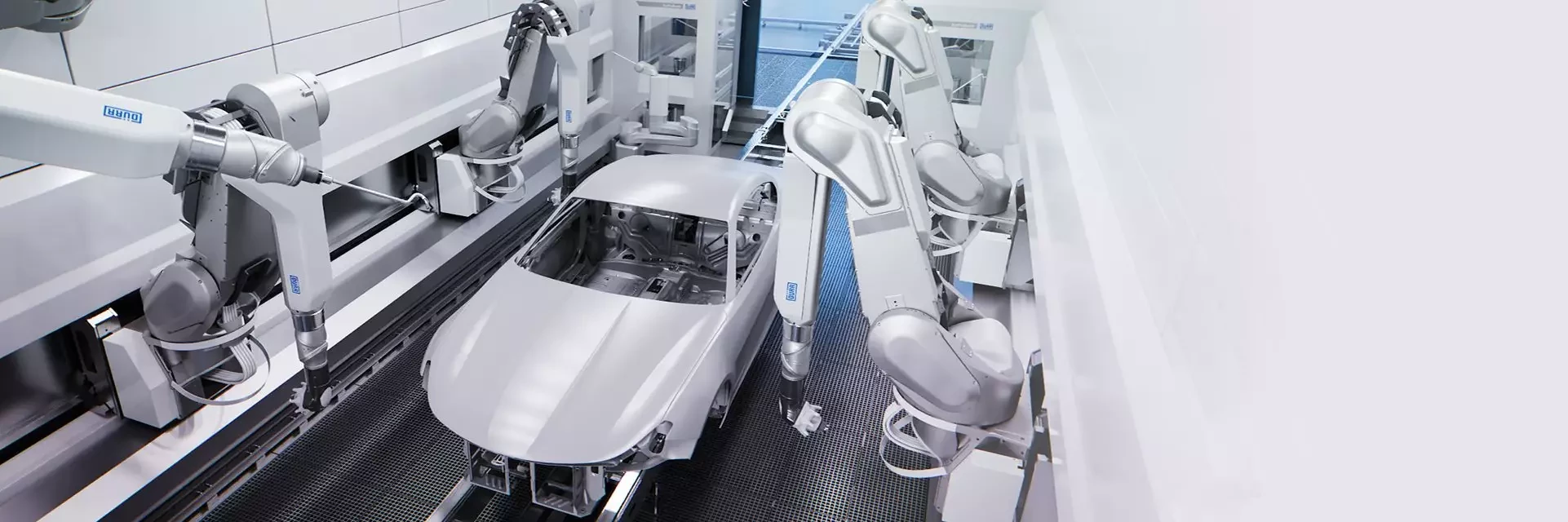

Technology leader:

With our technologies, we enable efficient production processes with a minimized environmental impact.

Digitalization:

The Dürr Group, as a mechanical and plant engineering firm, wants to retain its position as the market vanguard in the digital era. We are driving forward the digitalization of our products, services and processes under → digital@DÜRR.

High profitability:

The EBIT margin before extraordinary effects is to rise to at least 8%. We consider this level to be appropriate due to the increased share of mechanical engineering in our portfolio. The achievement of this goal is dependent on a normal market environment without any major disruptions.

Value creation:

We are aiming for a ROCE of at least 25%, based on high EBIT contributions in mechanical engineering and low capital employed in plant construction.

Sustainability:

Our economic activities are consistent with ecological and social concerns as well as responsible corporate governance. Our climate targets support the achievement of the global 1.5°C target and have been validated by the Science Based Targets initiative (SBTi). With our products, we enable resource-saving manufacturing processes.

→ Sustainability in the Dürr Group

Down to earth:

The Dürr Group has been in existence for over → 125 years. The company has developed from a workshop into a global corporation. At the same time, we have preserved the spirit of a medium-sized company in the best sense: Our employees have a sense of reliability and quality, they react quickly to changes and take decisive action. Just as customers expect from a medium-sized company. The hierarchies are flat, the paths short — and everyone pitches in. Even today, the founding Dürr family still holds more than 25% of the company.