China, a country almost as large as the United States of America, with over 1.3 billion people, is the most populous country in the world. Considered economically, China has the second biggest economy worldwide and with, from the perspective of other economies, fantastic growth of 9.2% in 2011 (Germany attained 3% in 2011). 48% of gross domestic product comes from industry, 42% is accounted for by services with the remainder being covered by agriculture. China, a member of the BRIC group of nations (BRIC: Brazil, Russia, India, China), has emerged as the rising economic power par excellence.

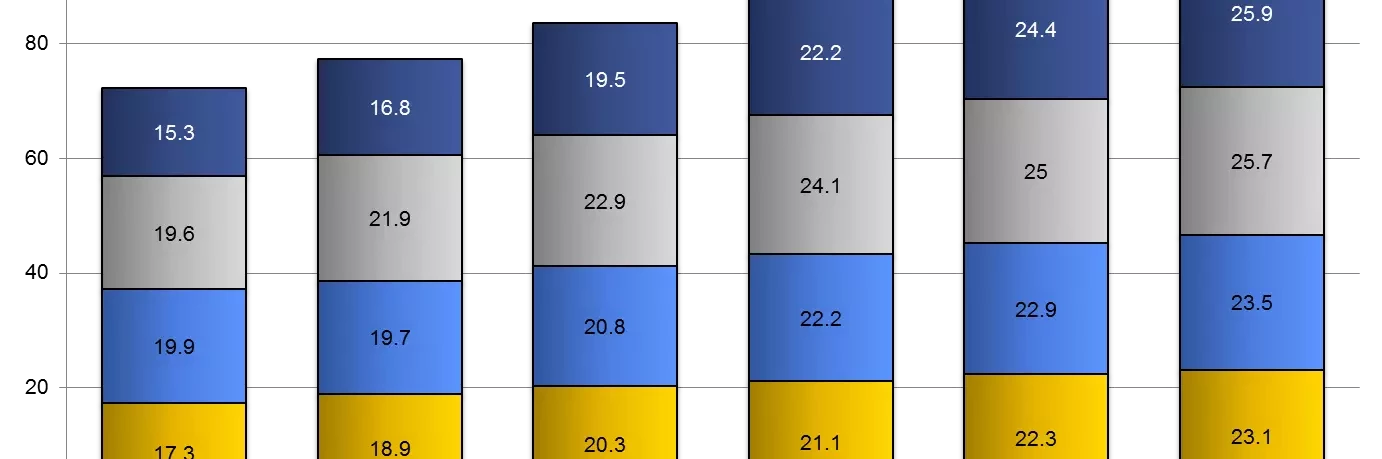

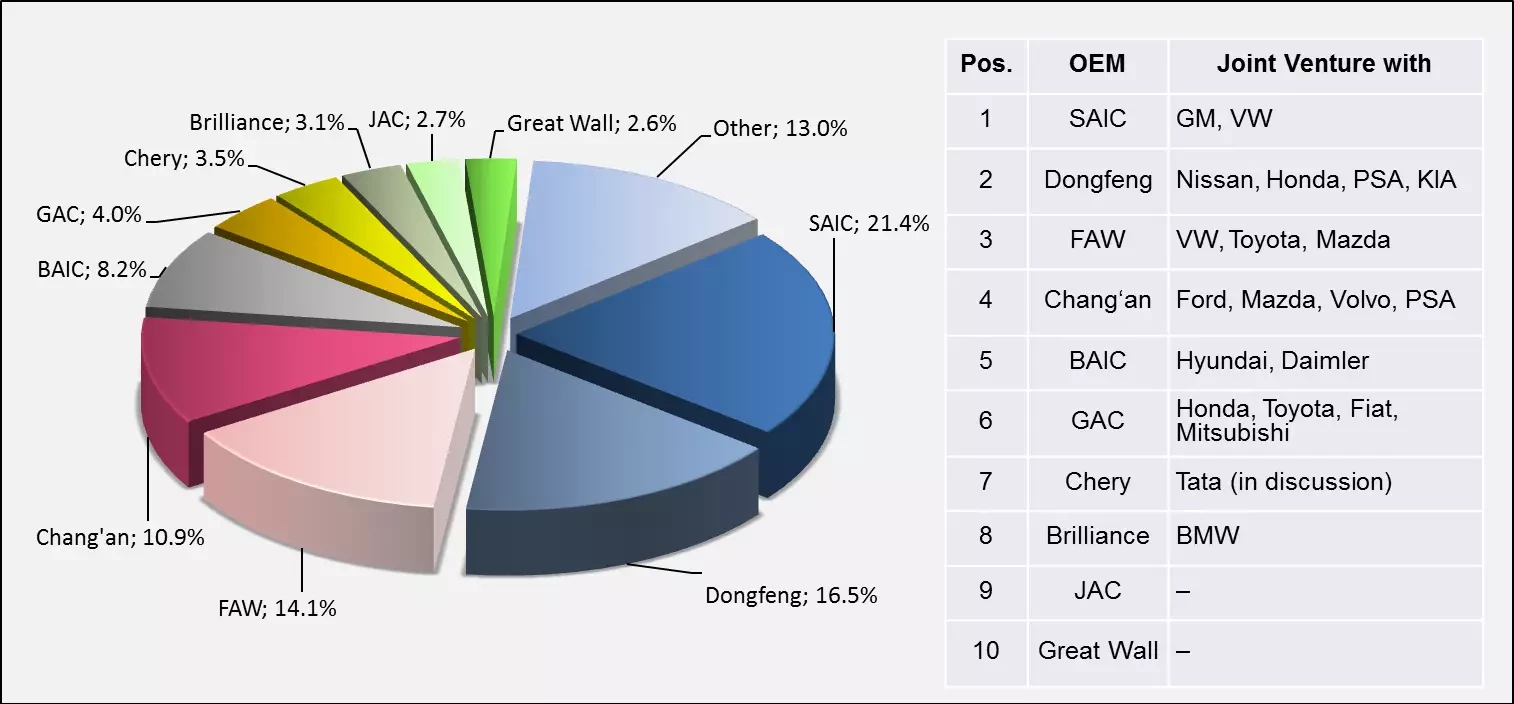

The rapidly expanding Chinese car market of earlier years has calmed somewhat in 2011. The main reason for this was the intervention of the Chinese government, which slowed economic growth slightly in order to limit inflation. The automobile industry is showing its continuing confidence in the Chinese market by investing billions in the construction of new production facilities. According to automotive experts from PWC (Price, Waterhouse, Cooper), Chinese “light vehicle” production increased in 2011 by 600,000 units, or 4.2%. This is about twice the value of growth in Western Europe (2011: 300,000 units or 2.3%).

There are many indications that the car market in China will grow in the coming years by more than the average due to the rise in real income and the growing need for individual mobility. In comparison with Germany, where currently there are more than 500 vehicles per 1,000 people, there are still less than 50 in China. This reveals a huge pent up demand. Against this background, PWC expects that automobile production in China between 2011 and 2016 will grow by more than 11 million units.

Automobile manufacturers in China are not only concentrating on the domestic market. Chinese car exports last year amounted to 824,000 vehicles, an increase of 50% over the previous year. The main customers are, so far, coming from emerging markets.

So much for statistics. What is the situation regarding automotive painting in China? A general objective of all Chinese auto manufacturers and joint ventures is to produce using the most energy efficient methods. To meet this objective, various approaches are available. The most important of these is the painting process, the production line layout and the plant itself. In addition to these, the application technology and individual investment volumes from OEM’s can be implemented or combined.

In the mid-nineties, a revolution took place in automobile finishing. A southern German manufacturer launched their new car on the market as the first to be painted using a new “compact” water-based painting solution. Briefly, in this context it means that the primer properties are transferred to the base coat layer, the conventional primer application is eliminated and thus the primer line. This sounds easy, but it was not. Real pioneering work, this was only made possible through the close cooperation between the three parties involved: the user, the coating material manufacturer and the plant supplier. The reactions to this innovation were initially relatively subdued. Gradually, other manufacturers ventured into this technology landscape, creating different concepts which are now grouped together under the term “compact painting.” There are now hardly any major car manufacturers who do not use of these processes. The advantages? Reduced investment, space requirements and energy consumption. The compact process has been now become well established including in the premium class. Back to China, this painting process has been applied in various formats. Formerly this was mainly in the form of a 3-wet solvent-based process. Now and in the future it will be as a water-based 3-wet process, due to recent environmental legislation. The users are mainly joint ventures, in which the Western partners dictate the process. It will certainly not take too long before compact painting processes establish themselves amongst purely Chinese manufacturers. This will be achieved, in part, because the Chinese partner in joint ventures will also build and operate their own plants.

Hand in hand with the process, the layout also determines the cost of the paint shop. Examples of this have been presented in previous Dürr articles and refer to the box concept for painting vans in combination with the 3-wet high solid process. 3-wet means nothing more than that all three paint components, primer, basecoat and clearcoat are applied directly one after the other without intermediate drying. The entire coated surface is cured only when the last coat has been applied and the unit is sent through the oven. The car bodies first pass through a cleaning station. Afterwards, the primer is applied to the exterior surface, in this case via a throughput station. This is then distributed amongst the individual boxes. In each box, the complete base coat and clear coat is finished inside and out. Each box can be operated with a variable cycle time that is adapted to the particular painting task. The advantages of the concept can be seen very clearly when compared to a sequential line of equal capacity. The box concept provides a solution with reduced investment and the lowest operating costs within existing boundary conditions. Why is this example mentioned again here? It’s simple: the system is currently being realized in China.

An innovative concept for truck painting with great variety:

The total number of robots used for the box concept is 42. In contrast to this, 64 robots would be required in a conventional, sequential painting line. The length of the washout system for the boxes is 58m, significantly shorter than a comparable conventional system, which would be 91m in length. This results in savings in energy consumption of around 36% and an investment savings of around 34%. The additional costs for more complex materials handling as well as the ventilation for the transfer zones in the box concept need to be considered. The reduced color change losses with the box concept should be mentioned. This amounts to nearly 5 tons of paint per year.

Keywords plant technology: Rotation dipping for pretreatment and electrophoresis with the well known advantages of shorter plant length, lower energy consumption and higher product quality has also found its way to China as the solution to drying process separation and paint overspray. In particular, energy saving dry separation from Dürr has now become a best seller in the Chinese market. The list of users is impressive: BMW Brilliance in Shenyang, FAW Audi and FAW Volkswagen in Changchun and Chengdu, SGM in Norsom, Yantai and Wuhan, SVW in Nanjing, Ningbo and Yizeng, Chery in Dalian and DFL Nissan in Huadu. The latter customer paints plastic body parts rather than car bodies.

Painting robots for exterior surfaces are now state of the art in China. It is certainly a fact that the automobile boom started later in China than in the western world, so that most of the plants have jumped ahead in terms of painting technologies. With the use of robots naturally comes paint application by high speed rotary atomizers and electrostatic paint charging. This has included the so-called bell-bell application process from the start, which increases transfer efficiency and delivers savings in paint used. Here too, an evolutionary step has been skipped. Equivalent to the exterior painting, the painting of interior surfaces is being developed through robotics. The air atomization application methods long used in the West is no longer discussed in China, most often only rotary atomization is discussed.

New developments in the field of systems and application technology in China now also permit more energy and resource efficient production. Each of the new technologies has delivered a significant improvement in environmental performance and has been combined with other beneficial effects. An excellent example is the energy consumption per painted body. A good value automotive paint shop uses between 700 and 900 kWh per painted body. The plant concept from Dürr, which is geared towards efficiency and sustainability, has pushed this energy consumption down to 430 kWh per painted car body. This is an absolute world record. This type of paint shop comes into operation next year in China.

Sources:

World Economic Outlook, Update January 2012, publication of the IMF (IMF: International Monetary Fund).

VR Chinas automobile market grows moderately. Germany Trade & Invest, 20.09.2011.

Schumacher, H.: Modular Paint box Concepts (”Modshops”) in Comparison to Conventional Sequential Paint Lines. SURCAR, June/July 2011.

Svejda, P.: Paint Box or Line concepts?. JOT 9, 2011.